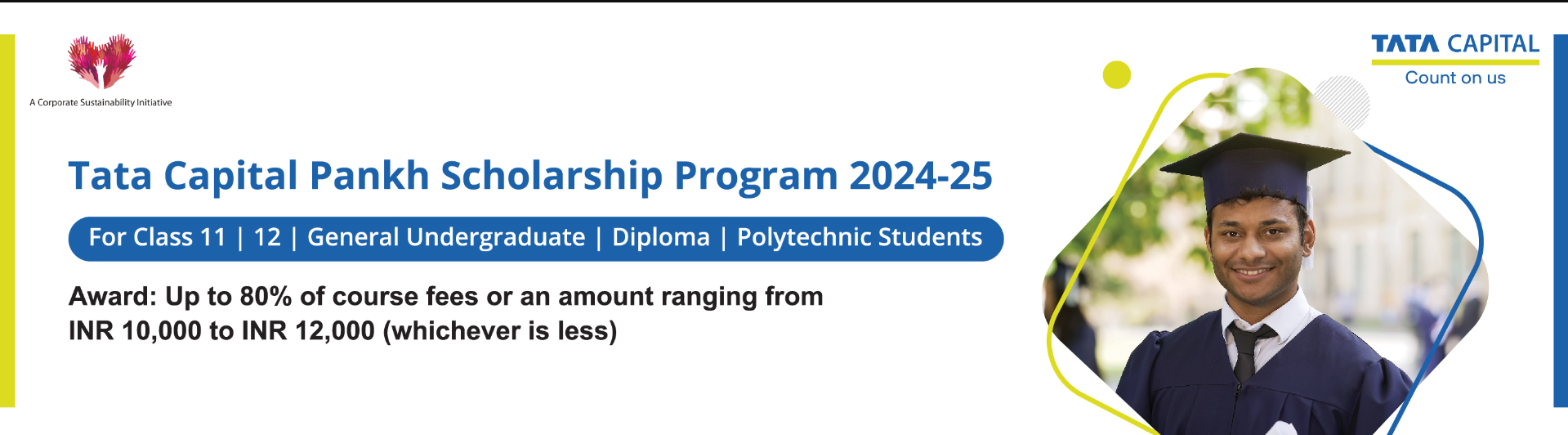

Tata Capital Pankh Scholarship Program 2024-25

June 7, 2025

June 7, 2025

June 7, 2025

June 7, 2025

June 7, 2025

June 7, 2025

June 7, 2025

June 7, 2025

June 7, 2025

June 7, 2025

June 7, 2025